Mobile Banking Trends 2020: Biometrics for Security and Payments

As always, the demand further drives the supply. By 2025, the global biometrics market is expected to reach $55.5 billion. So where exactly all that investment is going? And what are the benefits of pursuing biometrics as a financial institution (FI)? These are the questions we are exploring in this new installment of our Mobile Banking Trends series.

The Benefits of Biometrics Technologies in Mobile Banking

With the rising diversification of mobile payment and banking offerings, spanning across FinTech, TechFin, and traditional financing institutions, banks are under strong competitive pressure. Customer experience (CX), in particular, has become a core battlefield for attracting and retaining new clients. As much as 71% of financial executives believe that positive experiences in other sectors have driven an increase in customers’ expectations from their primary banking provider.

As we wrote in an earlier post on mobile banking trends, fast KYC and streamlined digital onboarding are essential components to better CX. However, such innovative solutions fall flat if they are backed by clunky, outdated security measures – multi-step password authentication, in-effective rules-based security or worse, the need to personally come to the branch for identity verification before receiving full access to the account.

Mobile and behavioral biometrics emerged as the new trends in mobile banking that effectively address those security shortcomings.

Faster Onboarding and KYC

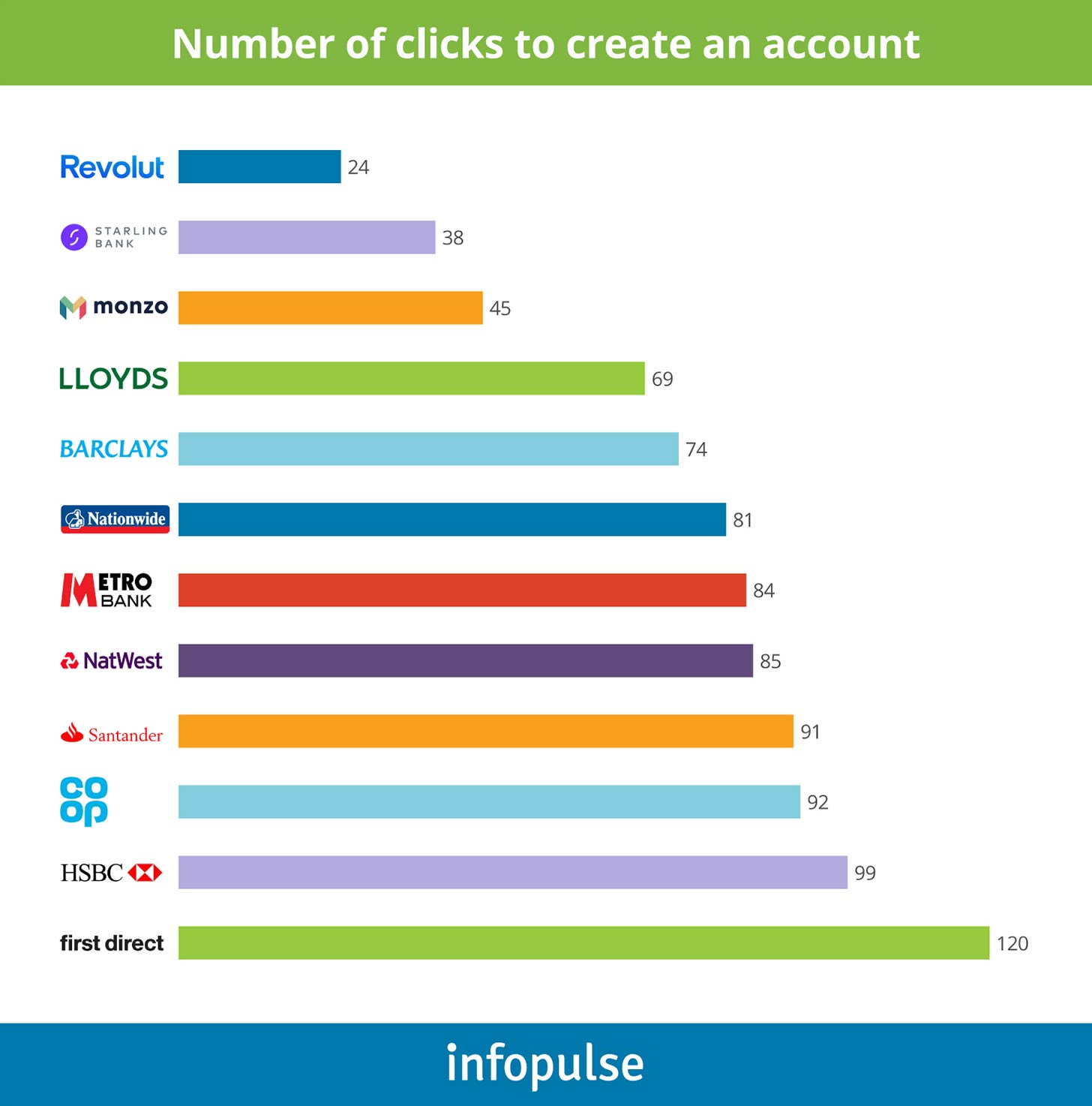

Instead of collecting signatures and physical ID copies, the most progressive banks now employ facial recognition to compare the submitted documents with the real-time photo of a new user. Doing so pays off. As identified in a recent UX study, it takes 5X times fewer clicks to open a mobile account with a digital-only challenger bank such as Revolut than with more traditional establishments such as Lloyds, HSBC or First Direct.

The faster you provide your new customer with access to their account – the sooner they begin building a habit of using your product and get on the path of becoming a loyal customer.

And if using biometrics makes you concerned about compliance, take a cue from Commerzbank. As part of their digital transformations, the German bank was planning to launch a new mobile banking app and onboard new customers remotely. However, the EU laws are rather stingy when it comes to remote customer identity verification. To avoid branch visits, the bank partnered with IDnow – a digital identity verification platform – that provided them with the tools to securely verify customer identity via smartphone video and biometrics data without breaching any compliance requirements. After implementing video verification, Commerzbank increased in-app conversions by 50% and simultaneously reduced unverified account applications by more than 20%.

Increased Security and Lower Cyber Fraud

One of the key reasons why biometrics made it to the top of mobile banking technology trends this year is because other security measures are losing their popularity among customers.

2FA, powered by OTP passwords – a long-living standard in the banking space – is neither convenient nor fully secure as a recent cyber attack on British Metro bank proved. The usage of card PINs for validating card transactions has also been debatable. Six out of ten consumers admit that they have too many PINs/passwords and constantly worry about forgetting them. As a result, 41% say that they reuse the same PIN code more than once, personally undermining the security of their finances.

The big boon of biometrics technologies is that they can be organically integrated at various steps of customer’s interaction with your product – to access the banking app, validate a payment, confirm a sensitive account action, etc. After all, the most commonly used type of behavioral biometrics such a finger scan is much more convenient than any custom PIN.

On top of that, by incorporating progressive biometrics security for a multitude of in-app actions, you increase the customer’s trust in your mobile banking product. According to PYMNTS research, 66% of Millennial banking consumers would like to have more authentication control to feel safer. Also, 33% of banking respondents indicate that they’d use their mobile banking app more frequently if their FI offered more protection against potential mobile app fraud.

Biometrics, along with other innovative approaches to cyber security, can help balance the need for greater safety with convenience. HSBC, for instance, was among the first banks in the UK to support Voice IDs and Touch IDs for customer authentication whenever they wanted to access some banking services over the phone or log into the mobile banking app.

BBVA went a step further and, together with Samsung, incorporated eye scanning as an authentication method for their mobile app.

Future-Proof Your Payment Experience

As innovative payment technologies come to the fore, PINs and passwords will only lose their popularity further. Biometrics is the key enabler for delivering a seamless, secure, and streamlined payment experience through the emerging payment avenues such as:

- Digital wallets (Google Pay, Apple Pay, Samsung Pay, etc.)

- IoT devices (such as health wearables, smart vending machines or commerce terminals)

- Connected cars (in-dashboard payments, parking or drive-thru orders)

Furthermore, as mobile e-commerce remains on the rise, banks should also look into new ways of preventing card-not-present fraud. In-banking app authentication for online payments, done via biometrics, is a solid alternative to 2FA and OTPs.

3 Innovations in the Biometrics Space to Keep an Eye on in 2020

Biometrics-powered Credit and Debit Cards

Mastercard, in partnership with Gemalto, recently certified a new contactless fingerprint payment card for the Bank of Cyprus and NatWest. Visa is also running biometrics card pilots in the US and Europe for several banks. This makes biometrics cards one of the rising online and mobile banking trends for 2020 and onward.

A recent survey of UK consumers, also revealed that most are on-board with using biometric payment cards:

- 82% said that such a card would become their preferred payment method

- 86% believe a biometrics card to be more secure than standard ones

- 82% also think that it may a more convenient payment method for them

For banks, issuing biometrics cards isn’t just another way of ensuring greater customer security and satisfaction – it’s a robust way of preventing AML fraud and reducing the volume of false-positives.

What’s more, a biometrics card is designed in such a way that the sensitive data is stored on the card itself, not within the proprietary systems. Meaning such cards do not transmit sensitive customer data over the air or otherwise expose personal details. This, in turn, can generate significant data storage and compliance savings.

What’s more, a biometrics card is designed in such a way that the sensitive data is stored on the card itself, not within the proprietary systems. Meaning such cards do not transmit sensitive customer data over the air or otherwise expose personal details. This, in turn, can generate significant data storage and compliance savings.

Behavioral Biometrics

Behavioral biometrics is a new wholesome approach to cybersecurity that attempts to personalize user security to their actions. While traditional biometrics gauges singular user metrics (fingerprint, iris scan, facial features), and traditional security measures sit atop of what the user knows (PIN, password, secret question), behavioral biometrics companies analyze the common user activities and patterns within them to determine what’s normal or abnormal behavior.

Much like anomaly detection, behavioral biometrics is driven by the usage of big data analytics and ML. Some of the current behavioral biometrics examples include mapping keystroke patterns, hand tremors, navigation, and finger movements within an application to a particular user to offer a greater degree of in-app personalization to them.

In mobile banking, behavioral biometrics has several prominent use cases:

- Account opening fraud prevention: By analyzing user’s online and offline behavior, banks can prevent usage of stolen or synthetic identities for new account opening.

- Account takeover fraud detection: Knowing what constitutes “normal” customer behavior, banks can identify account takeover attempts at the onset.

- Protection against social engineering voice scams: Such systems can detect and monitor against social engineering scams where an agent pretends to be a bank employee and attempts to fish for sensitive information.

The latter use case is also well-applicable to combating telecom voice fraud.

Digital, Biometrics-Powered, Customer Identities

Ultimately, most of the mobile banking industry trends are heading into one direction – creating an A to Z digital experience for banking customers. Biometrics is one of the centerpieces to assembling fully-digital, federated, and comprehensive digital customer identities that could be used for universal access to various banking products and services.

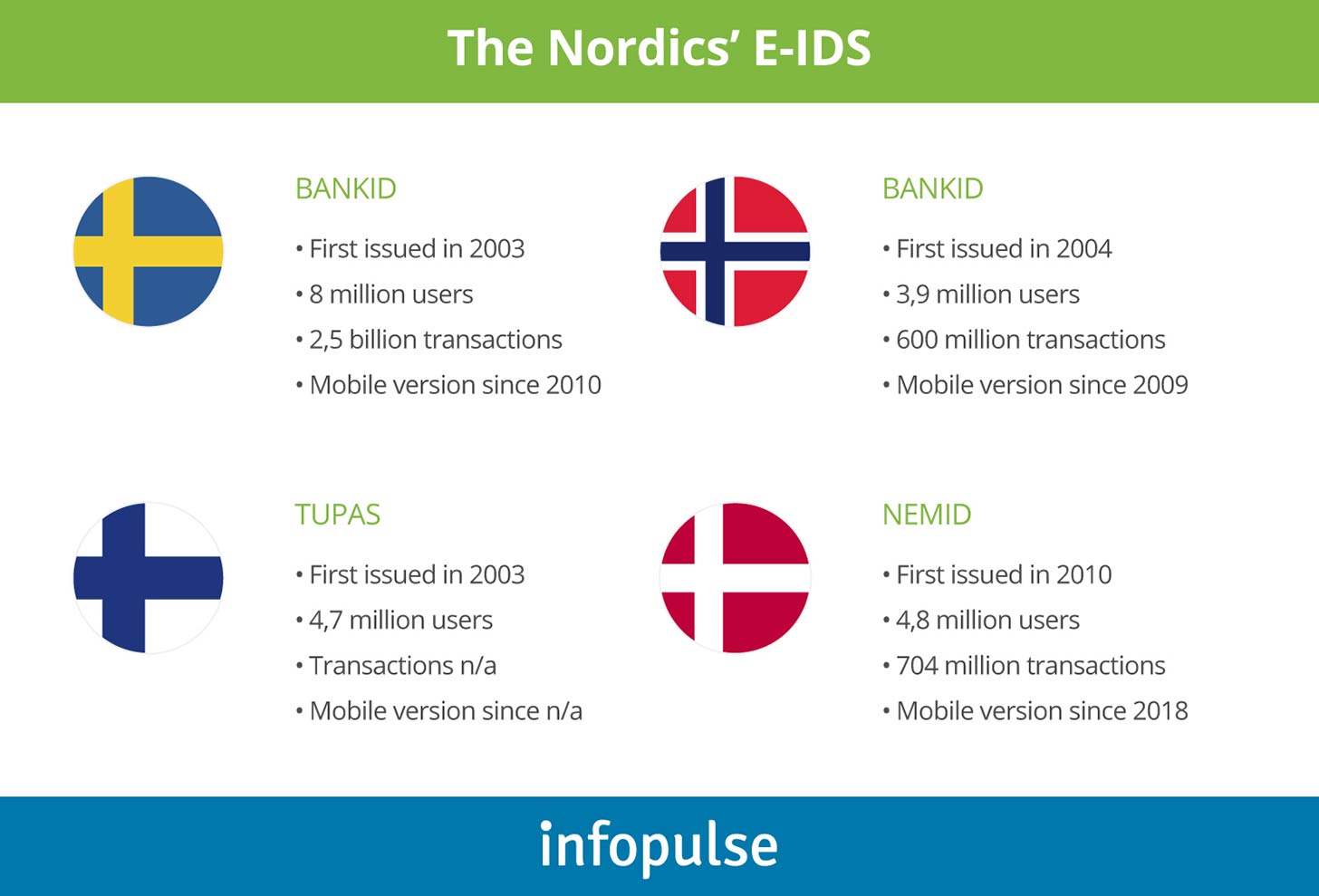

Nordic banks, in particular, have made significant progress in establishing a cross-country ecosystem of BankIDs that customers can use to sign up for or access services from any of the participating banks.

As Signicat reported, the gains from such a wide-spread e-ID adoption were paramount:

- In Norway, mortgage application time reduced from 16 days and 9 post shipments to 1 day and no papers, thanks to Bank IDs.

- In Denmark, the next iteration of NemIDs is estimated to save banks up to 25-50 million euros annually.

- 90% of the customers in the region now identify themselves with BankIDs when accessing online services.

Infusing such IDs with biometrics can further improve their security and foster even wider adoption for an array of services that require branch visits due to compliance requirements.

Conclusions

It’s certain: biometrics is an ‘assert’ to augmenting mobile banking security and convenience. And the latest trends in mobile banking show that most FIs and payment services providers are already way past the early pilot stages. To stay competitive and maintain a steady customer growth rate, your bank, too, should be looking into this direction.

Contact Infopulse team for a further discussion on the benefits and challenges of behavioral biometrics in the financial space! We are always available to provide a holistic overview of possible use cases and business benefits that your company can attain post-adoption!

![CX with Virtual Assistants in Telecom [thumbnail]](/uploads/media/280x222-how-to-improve-cx-in-telecom-with-virtual-assistants.webp)

![Generative AI and Power BI [thumbnail]](/uploads/media/thumbnail-280x222-generative-AI-and-Power-BI-a-powerful.webp)

![AI for Risk Assessment in Insurance [thumbnail]](/uploads/media/aI-enabled-risk-assessment_280x222.webp)

![Super Apps Review [thumbnail]](/uploads/media/thumbnail-280x222-introducing-Super-App-a-Better-Approach-to-All-in-One-Experience.webp)

![IoT Energy Management Solutions [thumbnail]](/uploads/media/thumbnail-280x222-iot-energy-management-benefits-use-сases-and-сhallenges.webp)

![5G Network Holes [Thumbnail]](/uploads/media/280x222-how-to-detect-and-predict-5g-network-coverage-holes.webp)

![How to Reduce Churn in Telecom [thumbnail]](/uploads/media/thumbnail-280x222-how-to-reduce-churn-in-telecom-6-practical-strategies-for-telco-managers.webp)

![Automated Machine Data Collection for Manufacturing [Thumbnail]](/uploads/media/thumbnail-280x222-how-to-set-up-automated-machine-data-collection-for-manufacturing.webp)

![Money20/20 Key Points [thumbnail]](/uploads/media/thumbnail-280x222-humanizing-the-fintech-industry-money-20-20-takeaways.webp)