7 FinTech Innovations Banks Should Watch to Gain an Edge In 2021

FinTech companies are steering aggressive competition for younger demographics by delivering financial products that perfectly match soaring customer expectations. Oliver Wyman report has identified that four out of five consumers’ needs of their financial life do not relate to legacy financial services businesses:

- Best possible price for essential goods;

- Consistent income on a weekly/monthly basis;

- Better visibility into available budget and guidance on spending;

- Easy/instant money transfers – anywhere, anytime.

Companies who have chosen to build their product around those needs are witnessing a massive growth. Businesses offering simple and low-cost transfer payment options have created a $400 billion in market capitalization. Those offering solutions to reduce the cost of spending created an even larger $600 billion in market capitalization.

Currently, these niches are heavily dominated by FinTech startups. Moreover, those traditional financial institutions who choose to stay aside, rather than double up on their innovation, risk losing the new generation of customers, especially in emerging markets.

The economic underpinnings are firm. The technology impact on banking will only grow stronger from now on as it is becoming more robust and accessible. Now maybe the right time to take a closer look at emerging technology trends in financial services and use those to “future-proof” your business.

Infopulse team has lined up seven major FinTech innovations, making a substantial impact on the financial industry and promising significant ROI for banks, who choose to explore them.

1. Digital Currencies are Entering the Institutional Investing Space.

Bitcoin prices may have plunged this year, but consumer demand and interest for the coin remain high. What is more interesting though, is that institutional investors are also making an entrance to the crypto-trading space.

Bloomberg has reported that institutional buyers such as hedge funds have been regularly conducting purchases of digital coins for sums exceeding $100,000 through private transactions. The over-the-counter market is estimated to be anywhere from $250 million to $30 billion in trade per day in April 2018. Clearly, more and more institutional investors are ready to embrace the crypto-trading space and potentially prepare to launch new financial services applications, catering specifically to digital coins operations.

In fact, Goldman Sachs Group – a former vocal critic of the digital currencies – decided to take the opposite stance and became the first bank to offer a bitcoin trading product to its customers. As of early November, the institution has been onboarding a selected group of clients to test their latest financial tech: a solution enabling the trade of bitcoin non-deliverable forward contracts. However, right now Goldman Sachs is not capable to store cryptocurrencies assets on behalf of its clients, though the demand for such services is high.

In fact, the demand for digital coin custodians has grown significantly over the last year and we expect this trend to remain strong in 2021. This is a major opportunity for trailblazing financial institutions who want to break into the crypto-space and deliver in-demand functionality to B2C and B2B customers.

Goldman Sachs is not alone in the race for crypto-trading customers. Nasdaq is also seeking regulatory approval of Commodities and Futures Trading Commission (CFTC) to become a cryptocurrency futures market operator.

2. Mobile Payments are Catching On.

Despite a sluggish start, mobile payments are now gaining more and more popularity among younger demographics. According to Visa study, 65% of those aged between 18-34 have used mobile payments online for purchases. The number of mobile payment users decreases to 42% for a broader demographic range. Additionally, nearly a half of millennials have been making face-to-face payments on mobile devices using Apple and Android Pay last year. In addition, over a half (57%) of Millennials use their smartphones and tablets to transfer money to friends and family.

Asia-Pacific region, in particular, leads the adoption of mobile payments and banking solutions. Shifting consumer demands and behaviors are shaping the new retail banking trends:

- 77% of Chinese consumers express interest in alternative banking and payment solutions.

- 61% of Chinese millennials also say that they would use IoT gadgets to access banking and financial services.

- 81% of bankers in the APAC region also believe that consumers now want a single entry point to all their financial needs and likely already have such projects underway.

Clearly, mobile phones are becoming the preferred method for storing personal financial data and conducting everyday payment operations. A lot of consumers view digital wallet services as a more secure alternative to plastic bank cards.

So, should banks feel threatened by digital wallet services? On the contrary, consumers’ increased preference for this medium can fuel additional financial services growth. First of all, by offering a custom digital wallet solution your bank can reduce the interchange fees imposed by credit/debit card issuers. Even a 2% reduction in those fees is a pleasant bonus.

Secondly, digital wallets present a new communication channel to reach your customers. Powered by real-time connectivity, they can become another revenue-generating touchpoint for your business. By gathering and analyzing users’ data, you can create highly personalized sales offers and pitch them at the right time, in the right place. For example, suggest an additional credit line to customers who have scheduled some recurring payments, but do not carry enough balance to pay them instantly.

Additionally, the new array of data can help you improve real-time fraud detection and create stronger security policies for new and existing customers, instead of abiding by the rules imposed by other service providers.

3. Digital Neo Banks Present Additional Competition.

Neo banks are one of the latest trends in the banking sector that will only grow stronger in 2021, especially in European markets. Fully digital, with low operational costs and no branches, these market disruptors lure in consumers with affordable pricing, superior CX and new-gen functionality such as:

- Cryptocurrency exchange products (Revolut);

- No fee credit cards (Nubank);

- Attractive foreign exchange rates;

- Multi-currency cards;

- Insurance products and more.

According to CB Insights, Revolut alone is processing over $1.8 billion of monthly spending across 28 countries in Europe and is nearing 3 million customer accounts.

Emerging markets currently represent the biggest new opportunity for digital banking product growth with high mobile adoption rates and large unbanked populations. Traditional banks should take note and consider entering the arena before FinTech startups overtake them.

A few other essential digital banking trends worth noting according to Deloitte:

- Banking customers share a stronger emotional connection with tech brands such as Apple, Amazon and Google rather than with their banks. This partially explains the rising popularity and adoption of mobile payments. Banks should take a closer look at how these brands managed to blend the physical and digital experiences and mimic those.

- Personal loan segment is a ripe field for disruptive innovation in banking. FinTech products now account for 36% of personal loans in the US by dollar volume. Banks could win back a growing segment of online lenders seeking solutions for college debt with better digital products.

- Partnership, instead of competition with neo banks is the strategy that could significantly improve the efficiency in larger financial institutions. Instead of building a new digital solution from scratch, banks could “outsource” certain operations to their digital partners.

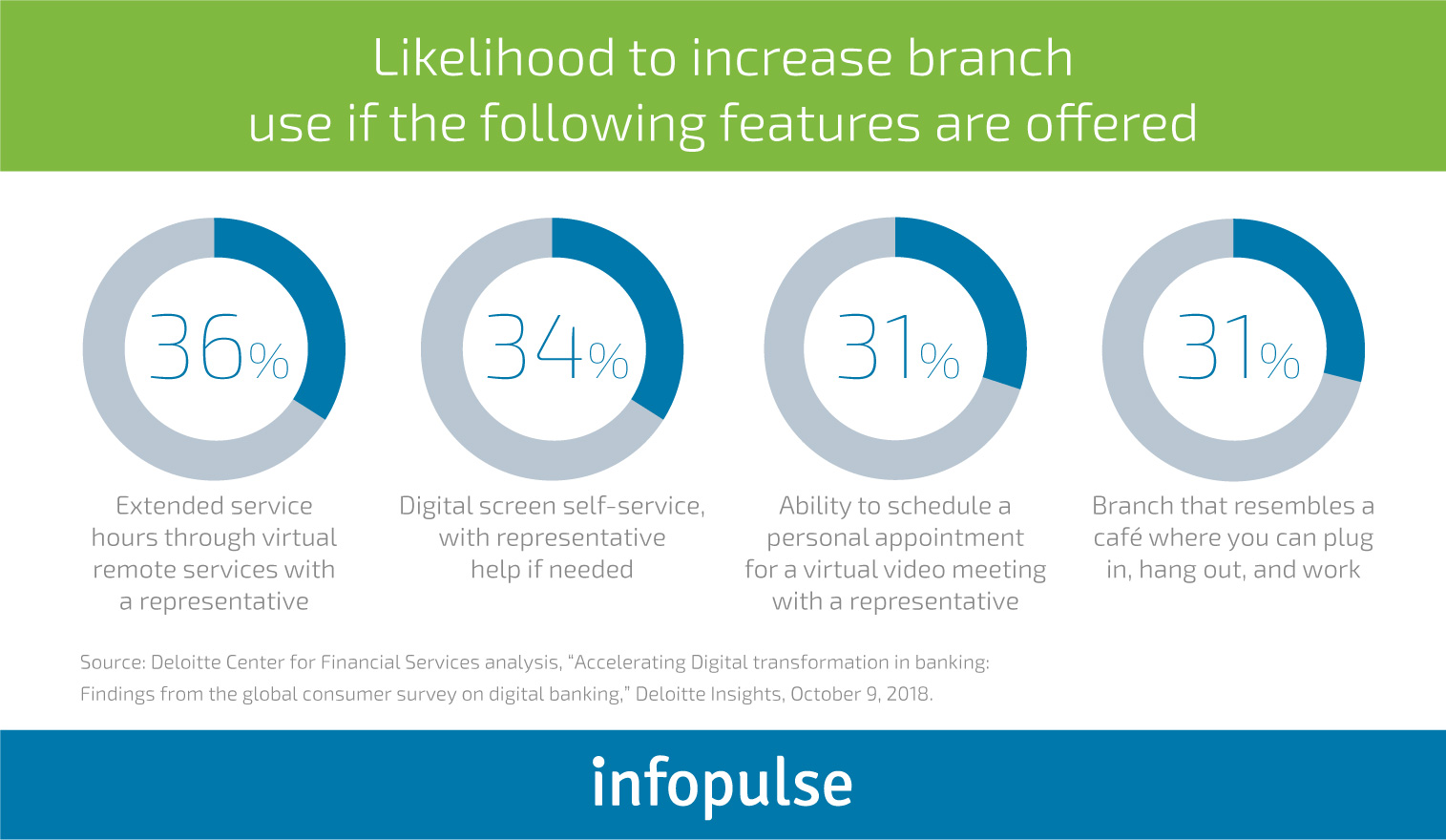

On the other side, consumers are not yet ready to completely forgo the branch and are willing to increase its usage when presented with the right set of features:

The latest banking technology should be geared towards improving omnichannel CX, rather than swinging towards either the digital or the physical side of things.

4. Cognitive Banking Helps Attain a Competitive Edge.

Cognitive computing is the new technology in finance that could help traditional banks outpace neo-competitors in the race for superior customer experience. Cognitive computing is an umbrella term for platforms capable to simulate the human thought process relying on technologies such as machine learning (ML), natural language processing (NLP), speech recognition, computer vision and others.

Combining your current banking analytics solutions with such “intelligent” assistants enables you to analyze and segment your customer base with the increased precision and create truly personalized experiences for each user.

ML-powered customer support

Smart systems can self-optimize over time and deliver personalized support to customers based on their past “knowledge” about their preferences and past behaviors. Wells Fargo piloted with an AI-driven Facebook Messenger chatbot earlier this year, capable to provide a general line of assistance to customers, e.g., help rest account passwords or provide account information. With the help of AI technology, they have established another medium for customers to quickly obtain necessary information in a conversational format, on a platform they frequent, instead of clicking through multiple website pages or leaving support tickets.

AI-driven investing

Robo-advisors are estimated to manage US $397,972 million in assets by the end of 2018. From a consumer perspective, such products offer:

- Better transparency into investment options and decisions;

- Increased accessibility through low/minimum fees and the ability to invest anywhere from a few cents to a couple thousand dollars per month;

- Attractive web and mobile UIs making the products accessible on-the-go and intuitive to navigate, unlike most traditional investment tools geared towards professionals, rather than amateurs;

- The use of exchange-traded funds (ETFs) to build diversified portfolios;

- Match the growing demand for passive investment options.

Consumer awareness of robo-advising products is already high. There is no point in waiting any longer if you want to ride on this technology trend.

Increased automation and reduced operational costs

JPMorgan Chase has recently deployed an AI-powered contract intelligence platform (COIN) that is said to save them over 360,000 hours of manual labor work.

McKinsey further estimates that in the next few years, AI systems will perform up to 10-25% of work across bank functions. However, to unlock this opportunity of cost reduction and labor optimization, banks should be taking a proactive stance on designing new processes that are suitable for automated performance rather than applying AI as a “patch” to an already low-value business process. This will also demand financial institution to grow their in-house capabilities for supporting the new way of working and establishing partnerships with vendors holding specialized domain expertise in the financial technology industry.

Smarter risk optimization

The particular advantage of AI-driven systems is that they can self-optimize over time by accumulating more data about various security threats and respond to them with greater confidence and at a faster speed. Such systems can process 2-4 times more data than human specialists, looking for repetitive patterns, identifying hidden relationships between different data points and churning new insights that can help you bulletproof your security without hampering CX.

Intelligent payment fraud detection

So far, one of the biggest AI trends in banking is “intelligent” payment fraud detection. Algorithms have become increasingly better than humans to spot abnormal behaviors, detect rogue trading or market abuse. The particular appeal is that detection can happen in real-time for multiple accounts. Mastercard was among the early adopters of AI-driven fraud management and managed to reduce the rate of false declines faced by customers by 80%.

5. Blockchain Use Cases Continue to Swell.

2018 has been a decisive year for blockchain – the technology finally moved from the margins to mainstream in several key industries including healthcare, supply chain management, insurance, government, and finance of course.

A record-setting $1.3 billion was invested globally in FinTech blockchain-based innovation projects. Progressive financial institutions have also ramped up their spending on internal bank technologies powered by the immutable ledgers. It is worth highlighting a few specific banking technology trends in this regard:

Innovations in transaction banking

Most banks are still stuck with a number of manual and inefficient processes, e.g., account reconciliations that are costing them a handsome budget. To be precise, IT and operations costs in capital markets are estimated to be $100-150 billion a year.

Blockchain technology has long been identified as the “best candidate” to reduce such costs and introduce a higher level of automation. BNP Paribas has successfully placed this theory to a test and recently completed a pilot for an end-to-end fund distribution transaction on the blockchain. Investors largely benefit from reduced transaction processing time, while the bank itself profits from a streamlined system experience, relevant for all fund types and geographies.

According to estimates, the ROI of blockchain-based financial technology for clearing and settlement operations is very lucrative:

Peer-to-peer lending on blockchain

The global P2P lending is expected to become a $1 trillion market by 2025, dominated by a number of popular FinTech startups such as Circle, Lendoit, and others.

That is unless banks will come up with innovative financial services to address this demand for faster, better and more streamlined lending process. Blockchain technology plays a key role in this case as it’s the ultimate “candidate” for simplifying the due diligence process for both parties.

All the customers’ financial data can be recorded and stored on an immutable ledger, giving the lending institution a complete and real-time view of applicants’ affairs – full transaction history, details of outstanding bills, inflows and outflows, and so on. When such data is available, lending decisions can be made programmatically in a few minutes, not days. Furthermore, smart contracts can govern the settlement process and automate the execution of all lending terms. Blockchain also enables higher data visibility for regulators, investors and auditors – again, largely improving and simplifying the lending/borrowing transactions. ING and Credit Suisse recently became the pioneers in the space by executing the first-ever live securities trade on a blockchain platform, swapping EUR 25 million worth of high-quality liquid assets.

Other trends that will denote the future of financial services in regards to blockchain technology are as follows:

- Corporate investments in consortia will continue to grow

The main goal of consortia is to establish clear interoperability standards and common operational grounds for competitive companies that want to use proprietary ledgers. R3, Hyperledger, and the Enterprise Ethereum Alliance (EEA) raised massive investment rounds this year and gained new supporters among financial institutions. In 2021, we should expect more pilots from them, going beyond the current successes in cross-border payments and syndicated lending. - New KYC (Know-Your-Customer) solutions

Banks are increasingly experimenting with the usage of private or public blockchains for customer identification. The most notable projects so far are R3’s Corda, Cambridge Blockchain, Credits and Blockstack. IBM has also forged their way into digital identity management on the blockchain. Clearly, in 2021 we should expect more practical use cases to enter the market. - The demand for blockchain expertise keeps rising

As more companies invest in new-gen financial technology services, great talent is becoming harder to find. Since 2017, the demand for blockchain engineers on Toptal alone has increased by 700%. Infopulse blockchain development team has also witnessed an increase in service inquiries in 2018, and we expect to start more new partnerships in 2021 as well.

6. Biometric Authentication – The New Security Mechanism to Consider.

Digital banking solutions demand a new kind of security experience. Most customers want to move beyond passwords and two-step authentication procedures towards a single identity credential for a variety of authentication purposes in banking.

A biometric solution for authentication is currently among the most preferable options for 23% of US consumers; 26% of UK consumers and 40% of German consumers. For banks, this presents a great opportunity to modernize their customer experience and reduce the fraud management costs.

Some financial institutions are already experimenting with biometric authentication at ATMs. Neo banks such as Revolut support in-app fingerprint authorization. Britain’s Lloyds Banking Group and Commonwealth Bank of Australia rolled out support for the iPhone X’s Face ID feature as a mean of authentication. Bank of America collaborated with Samsung to develop an eye-scanning technology that would serve as an authentication method for accessing the bank’s mobile app.

The next step in the industry is to move towards a single authentication hub that would facilitate multi-factor and multi-modal authentication and leverage transactional data to adjust security settings and balance risks.

A more significant innovation in financial services (and beyond them) is the rise of augmented identity solutions. Companies like Idemia are now proposing enhanced biometric solutions that protect the customers’ personal data using the latest security technologies; and at the same time – make that data easy to use for authentication purposes anywhere, anytime.

Some of their innovative solutions for the financial niche include:

- F.Code: Fingertip as a credit/debit card pin code opening the era of biometric cards.

- Biometric Enrollment Services: Capture and register customer’s biodata in-branch or at home using a specialized tablet that will codify that data and store it directly on the payment card.

- Adaptive Authentication: Enables banks to dynamically prompt the best authentication options for different users, depending on the actions they want to perform. Depending on your policy, you can propose different customers to use mobile, SMS OTP, biometrics or passwords for authentication or a mix of these methods.

Biometric authentication is gradually becoming more widespread as it offers a great way of balancing security and customer experience.

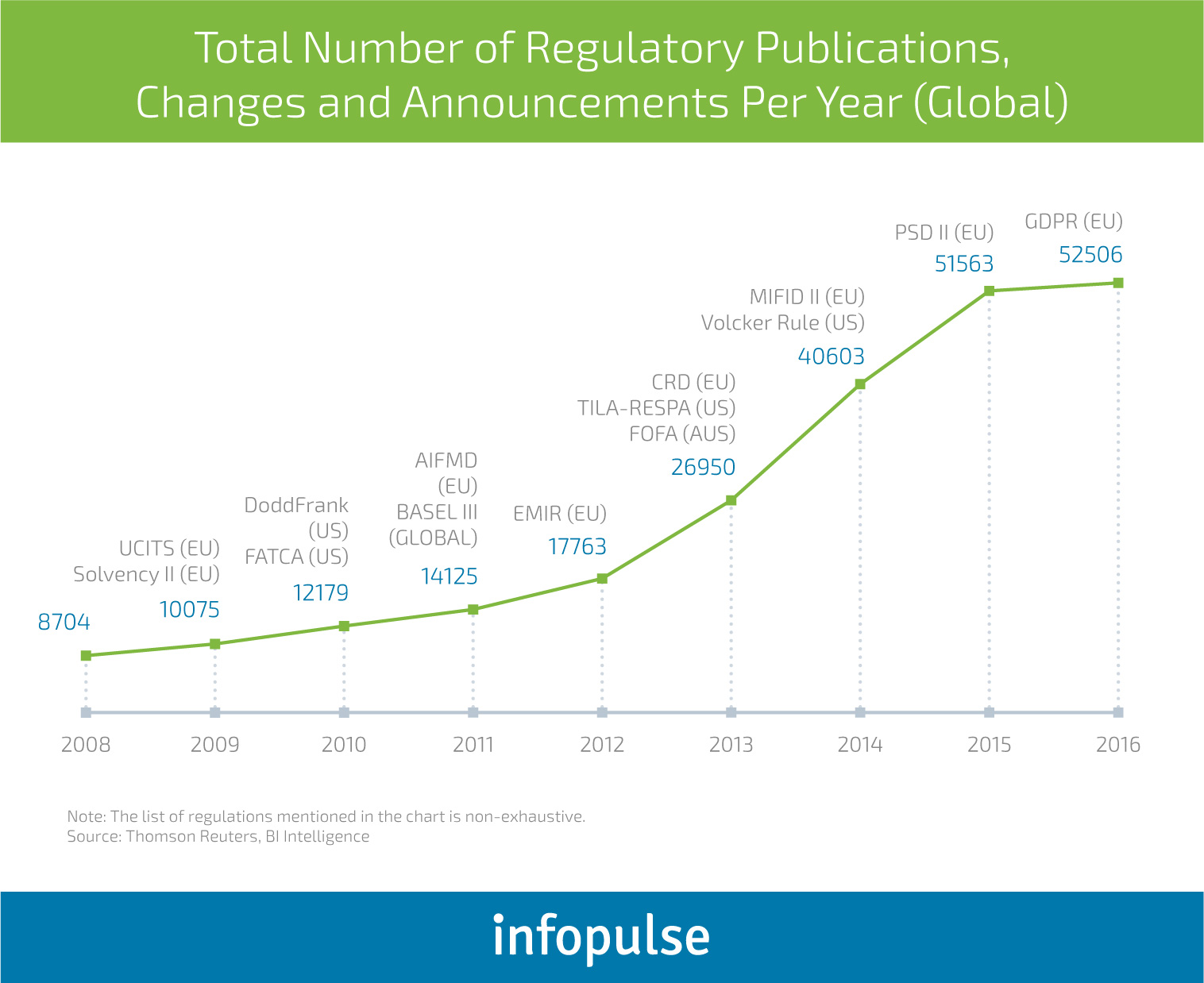

7. Regulatory Technology Can Bring Massive Cost Reductions.

The RegTech universe is expanding to address the mounting costs of compliance for financial institutions (estimated to be approx. $100 billion in 2017). No wonder as in the US, 15 different regulators oversee the financial service industry. On a global scale, keeping tabs on all newly imposed regulations is even more challenging:

The need for new technology in finance industry to address those mounting compliance tasks is ripe. Moreover, a few startups have already come up with some curious solutions. For instance, Ripcord leverages natural language processing algorithms to search records, certify that they are compliant and build up a digital audit trail that regulators could access. Corlytics conducts risk-based analysis of critical and emerging regulatory topics to help users align their audit, risk and compliance programs and investments.

A number of proprietary RegTech solutions are also underway. BBVA UK and Latvian ABLV Bank have collaborated with OneSumX solution by Wolters Kluwer to improve their regulatory tracking, reporting and compliance.

In 2021, we expect to see more financial companies seeking RegTech technological partnerships. After all, end-to-end RegTech implementation promises 634% ROI in over a three-year period.

Balancing FinTech Innovations with Operational Changes

The FinTech industry has generated a lot of excitement, and traditional financial institutions now feel more pressure to keep up the lead and innovate at an equal pace. While FinTech startups are bound by fewer regulations, most of them cannot go too far on their own. That is why partnerships between the banks and startups will be plentiful in 2021.

The use of new technology in banking also assumes major changes to existing software architectures, business workflows and new implementation/deployment challenges. Financial systems are convoluted. Meaning that most banks cannot simply “plug and play” a new disruptive solution to a legacy system without carefully considering implementation tradeoffs.

Financial stakeholders should take a clear stance on how they plan to innovate without hampering existing systems. New technologies will have a strong short- and long-term impact on all business processes and systems that should be taken into account. Clearly, there will be risks involved, as well as considerable rewards. Finding the right technology partners with extensive domain expertise becomes crucial at this point.

To learn how Infopulse team can help you bridge the gap between operational challenges and disruptive technology adoption, visit our dedicated page on banking and financial technology services.

![CX with Virtual Assistants in Telecom [thumbnail]](/uploads/media/280x222-how-to-improve-cx-in-telecom-with-virtual-assistants.webp)

![Generative AI and Power BI [thumbnail]](/uploads/media/thumbnail-280x222-generative-AI-and-Power-BI-a-powerful.webp)

![AI for Risk Assessment in Insurance [thumbnail]](/uploads/media/aI-enabled-risk-assessment_280x222.webp)

![Super Apps Review [thumbnail]](/uploads/media/thumbnail-280x222-introducing-Super-App-a-Better-Approach-to-All-in-One-Experience.webp)

![IoT Energy Management Solutions [thumbnail]](/uploads/media/thumbnail-280x222-iot-energy-management-benefits-use-сases-and-сhallenges.webp)

![5G Network Holes [Thumbnail]](/uploads/media/280x222-how-to-detect-and-predict-5g-network-coverage-holes.webp)

![How to Reduce Churn in Telecom [thumbnail]](/uploads/media/thumbnail-280x222-how-to-reduce-churn-in-telecom-6-practical-strategies-for-telco-managers.webp)

![Automated Machine Data Collection for Manufacturing [Thumbnail]](/uploads/media/thumbnail-280x222-how-to-set-up-automated-machine-data-collection-for-manufacturing.webp)

![Money20/20 Key Points [thumbnail]](/uploads/media/thumbnail-280x222-humanizing-the-fintech-industry-money-20-20-takeaways.webp)